Prime Minister Sebastien Lecornu's first week on the job ended with a credit rating downgrade for France

Paris (AFP) - French politicians on Saturday sounded the alarm after the Fitch agency downgraded the country’s credit rating, with opponents of President Emmanuel Macron urging a break from what they called his “toxic” policies.

The US ratings agency, one of the top global institutions gauging the financial solidity of sovereign borrowers, downgraded France late Friday on its ability to pay back debts, from “AA-” to “A+”.

It also said France’s debt mountain would keep rising until 2027 unless urgent action was taken.

The downgrade comes just days after Francois Bayrou resigned as prime minister after losing a parliamentary confidence vote over an attempt to get an austerity budget adopted.

The announcement drew cross-party criticism of the government, much of it directed at the French president.

Far-right figurehead Marine Le Pen on Saturday called for a “break with Macronism”, denouncing his policies as “toxic incompetence”.

France “has no more time to waste with politicians who are prisoners of their own cowardice, who have nothing to offer but tax hikes, the sacrifice of social gains and across-the-board cuts to make up for their fiscal mismanagement,” she wrote on X.

Hard-left leader Jean-Luc Melenchon, who has called for Macron’s impeachment, likewise urged “an end to Macronism and its policies harmful to France and its people”.

Members of the outgoing government also voiced concern after the Fitch agency’s decision.

Outgoing Interior Minister Bruno Retailleau said the downgrade was a punishment “for decades of fiscal mismanagement” and “chronic instability”.

Bayrou, who pushed major spending cuts in a bid to cut the French deficit and debt, said that France was “a country whose ‘elites’ lead it to reject the truth (and) is condemned to pay the price”.

The downgrade will further complicate the task of new Prime Minister Sebastien Lecornu, probably heading a minority government, of drawing up a budget for next year.

“The government’s defeat in a confidence vote illustrates the increased fragmentation and polarisation of domestic politics,” Fitch said in a statement.

“This instability weakens the political system’s capacity to deliver substantial fiscal consolidation,” it added, saying it was unlikely the fiscal deficit would be cut to three percent of GDP by 2029, as the outgoing government had wanted.

Outgoing Economy Minister Eric Lombard acknowledged the agency’s move, but insisted on the “solidity” of the French economy.

A rating downgrade typically raises the risk premium investors demand of a government to buy sovereign bonds – although some financial experts had suggested the debt market had already priced in an expected downgrade for France.

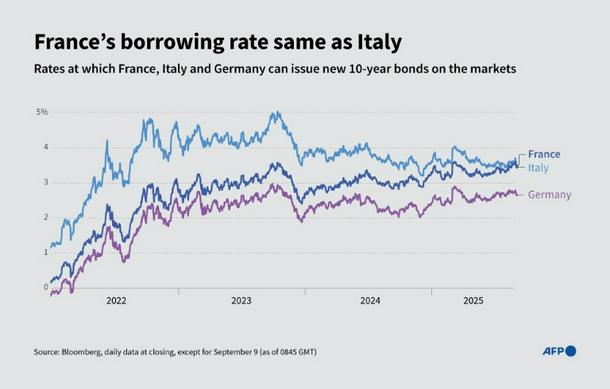

On Tuesday, the return on French 10-year government bonds, known as the yield, rose to 3.47 percent, close to that of Italy, one of the eurozone’s worst performers.

- Unclear horizon -

Rising yields would translate into higher costs for servicing France’s debt, which Bayrou warned was already at an “unbearable” level.

France's borrowing rate almost the same as Italy's

Since Macron’s allies in parliament have no overall majority, they will likely have to make compromises that could undermine any drive to slash spending and raise taxes – with Lecornu’s job potentially also on the line.

France’s budget deficit represented 5.8 percent of gross domestic product (GDP) last year, and its debt 113 percent of GDP.

This compares with eurozone ceilings of three percent for the deficit, and 60 percent for debt.

“Fitch projects debt to increase to 121 percent of GDP in 2027 from 113.2 percent in 2024, without a clear horizon for debt stabilisation in subsequent years,” the agency said.

“France’s rising public indebtedness constrains the capacity to respond to new shocks without further deterioration of public finances.”

France is still cautiously targeting economic growth this year. The INSEE national statistics bureau said Thursday that GDP was projected to grow by 0.8 percent for 2025, 0.1 points more than the previous government’s estimate.

Rival agency S&P Global is due to update its own sovereign rating for France in November.

burs-mpa-ekf/yad